|

|

|

| SMBS : Secure Mobile Banking System |

| Introduction : |

|

The penetration of mobiles has been growing at an exponential rate world over. As a transaction originating & processing device, mobiles are becoming an enabler for financial inclusion. The mobile banking revolution perhaps would be the greatest enabler in increasing the bank's reach in the remotest villages in the country.

|

|

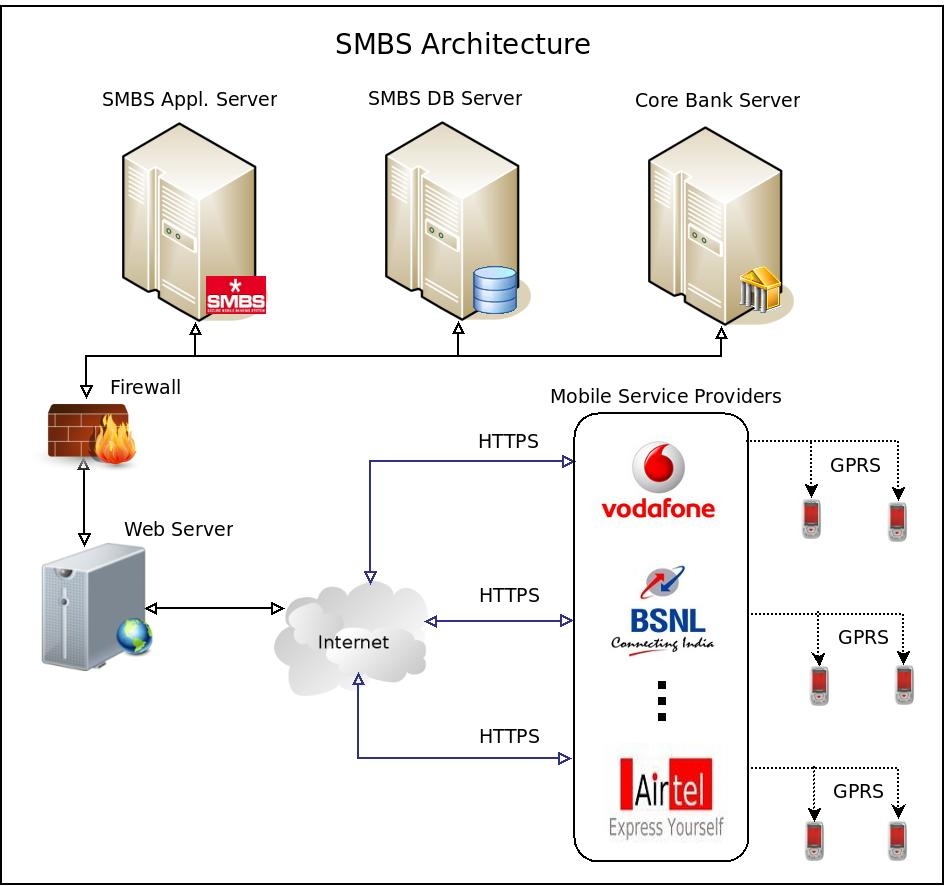

Secure Mobile Banking System (SMBS) is the leading edge mobile technology solution from BK Systems. SMBS enables the bank customers to use their mobile handset for performing their banking operations in a secure and confidential manner. The banking services can be accessed through standard text based SMS, Encrypted SMS (or secure SMS) and GPRS enabled handsets on a single technology platform.

|

|

SMBS leverages the advances in the mobile & computing technology to empower the banks to provide innovative mobile banking services to its customers, thereby bringing the service differentiation. The customer's user experience would also be secure, richer, convenient and delightful.

|

|

SMBS server works on Linux OS which is rugged, virus free and optimised for delivering high performance. SMBS client application would work in all major Mobile phone operating systems which provides support Java Runtime environment.

|

|

SMBS provides the following methods for integration with Core banking solutions, payment gateways, other host systems.

|

|

ISO 8583 based messaging |

|

Connect24 (native API from Infosys) based messaging |

|

XML based messaging interface |

|

HTTP based interface to backend systems |

|

ODBC connectivity based interface |

|

TelAPI (native API from BK SYSTEMS) based interface |

|

Database download |

|

| Mobile Client Application : |

|

Language : Java/J2ME |

|

SDK: J2ME Wireless Tool Kit |

|

Runtime Environment: All Java Enabled mobiles |

|

Network Connectivity: GPRS (General Packet Radio Service) |

|

| SMBS Server Application : |

|

Operating System: Linux 2.6.28 |

|

WebServer: Apache2 |

|

Language: Perl, Ruby, Ruby on Rails and PHP |

|

Protocol: HTTPS |

|

|

| Typical Mobile Banking Services |

|

The list of typical mobile banking services that are offered by SMBS are as listed below. The services provided would depend on the type of integration capability provided by the back end systems/payment gateways.

|

| Retail Banking Services : |

|

Balance Enquiry |

|

Mini Statement |

|

Cheque Related Information |

|

Cheque Status |

|

Stop Cheque |

|

Cheque Book Request |

|

Funds Transfer |

|

Own Accounts Transfer |

|

Inter-Bank Transfer |

|

Intra-Bank Transfer |

|

SMBS Profile |

|

Change Primary Account |

|

Change Inquiry PIN |

|

Change Transaction PIN |

|

My Services |

|

Upgrade SMBS |

|

General Information services |

|

Request for Debit Card |

|

Request for ATM Card |

|

Deposit Rates Information |

|

Forex Rates Information |

|

Bullion Rates Information |

|

Location of ATM |

|

Location of Branch |

|

Feedbacks and Complaints |

|

About SMBS |

|

Logout |

|

| Credit Card Services |

|

View Statements |

|

View unbilled transactions |

|

Make Payments for credit card dues |

|

Make payments for merchant transactions using credit cards |

|

Payment History |

|

Reward Points & Redemption |

|

| DEMAT Services |

|

|

Holding Statement |

|

Transaction Statement & Status |

|

Bills Enquiry |

|

Stocks Enquiry |

|

View unbilled transactions |

|

| Value Added Services |

|

|

Mobile pre-paid top up |

|

Utility bills payment eg Electricity, Telephone |

|

Other payments eg school fees |

|

Ticketing eg Railways, Airline, Bus, Movie |

|

Payment to places of worship/pujas etc |

|

| Other Generic Functions : |

|

The following generic services related to logging, security and usage are inbuilt into SMBS

|

|

2-Factor based authentication for registration of service |

|

Multiple modes of registration - SMS, Web Site, Request at Branch, Request at Call Center |

|

2 level PIN system - MPIN for login; TPIN for transacting |

|

Locking of PIN/TPIN upon configured number of authentication failures |

|

PIN/TPIN never stored in the handset |

|

Session expiry upon lapse of configured time of inactivity |

|

End-to-End encryption |

|

Digital signature based encryption |

|

Provision of funds transfer limits - user level, service level and cumulative level |

|

| SMS Alert & Bulk SMS services: |

|

Typical Alert and Bulk SMS services which supported by SMBS are detailed below.

|

| Alert Services |

|

This facility can be used by the bank to proactively inform the customer about the transactions happening on the account. For providing these services, the core banking interface should send messages to SMBS Server whenever the respective event occurs. SMS alerts to the customers can be classified into the following two categories.

|

| Event Based Alerts : Event based alerts are those SMS messages which are sent to the customers whenever the configured event occurs eg Salary Credited, Account Credited, Account Debited, Cheque Bounce. |

| Limit Based Alerts : Limit Based Alerts are those informed to customers whenever their balance amount reaches a minimum or maximum value. |

|

| Bulk Services |

|

In this type of SMS messaging service, the bank would be able to send SMS to large number of customers automatically and within a very short time. The typical services provided under this category are Day End Balance, Interest rate changes, Intimation of payments due, Product Advertisements, Seasonal and personal greetings etc

|

|

| Download PDF |

|

|

|

|